Historical MAFL Fund Performance

Men’s

The first couple of years of MAFL were, we now know, all too easy, the Recommended Portfolio returning 12.2% and 9.2% in 2006 and 2007 respectively (actually a good deal more in 2006 after the Special Stupidity Dividend - for details download the 2006 Newsletter #19.1 from the "MAFL - The Early Years" tab).

In 2008, MAFL's Recommended Portfolio recorded its first loss, and an impressive one it was at that, with the final share price for the Portfolio ending its apparent freefall at just over 72c, despite rebounding by just over 6c courtesy of the Hawks' Grand Final victory. It was not untit 2015 before the Recommended Portfolio would return worse numbers.

2009 saw a return to profitability, albeit only just, as the Recommended Portfolio finished at $1.01 after dropping almost 12c in the last two rounds of the season. Never was an off-season so welcomed.

A fitful 2010 season for the Recommended Portfolio saw it finish at a tick under 95c, never fully recovering from a horrible Round 8 in which over 11c was carved out of its price.

2011 heralded the entry of the Gold Coast into the competition, and the difficulties in rating this new team, coping with byes for the first time in MAFL history, coupled with an ill-considered decision to commence wagering from Round 1 of the season, resulted in a loss of over 25c for the Recommended Portfolio. The loss was mitigated - a tad - by the Line Fund's profitability, making it two successive years of profitable line betting in MAFL and offering some hope for this form of betting in the season's ahead.

Or so I thought then. 2012 provided the third successive loss for Investors, this time due mainly to a highly-unprofitable foray into margin betting, which resulted in the lowest ever end-of-season price for a single Fund as the dully-named and direly-performing Margin Fund limped out of September valued at just 12.5c.

Mercifully, MAFL's poor run of form reversed in 2013 with, for the first time ever since the term "Recommended Portfolio" meant anything, every Fund in that Portfolio making a profit. Much of the profit, especially that of the Line Fund, was due to the newly-introduced policy of "variable cap" wagering in which Funds were permitted to wager smaller or greater amounts at different points in the season on the basis of the Fund's historical wagering performance at that time of the season.

That form reversal continued into 2014, which saw MAFL record back-to-back profits for only the second time in its brief history, though in that year profitability was attributable solely to the outstanding performance of the Line Fund. It called the coin toss that is Line betting correctly in over 57% of the games where it chose to participate, making it five straight seasons in which some version of this Fund has broken even or made money.

Then came 2015, the darkest season in MAFL wagering history, with the Head-to-Head Fund shedding almost one-half of its value, and the Line Fund shedding about one-third. Combined, that meant the Recommended Portfolio finished at just 63c, worse even than the 72c figure in 2008. As a direct consequence of this performance, both the Head-to-Head and Line Fund algorithms were permanently retired and replaced by an all-new team rating-based algorithm for 2016.

Fortunately, regression to the mean then manifested, with two of the three Funds in 2016 - one a completely new Fund wagering successfully in the overs/unders market - registering profits, and the Overall Portfolio finishing the season up by just over 13%, a then MoS record.

In 2017, all three Funds finished in profit, a feat achieved only once before(in 2013) in years where MAFL has comprised at least two Funds. Combined using the recommended weightings, the Funds provided a Recommended Portfolio profit of almost 32%, the highest single year return in MAFL history, even including the Special Stupidity Dividend of 2006.

And then, in 2018, it was the Line Fund that was left to do all the heavy lifting, but its 18c gain wasn’t enough to offset the 17c loss by the Head-to-Head Fund, and the 22c loss by the Overs/Unders Fund, which left the Recommended Portfolio down by 6.2c on the season, with a -3.1% ROI on a 2.02 turn.

That was followed by a record-breaking 2019 in which both the Head-to-Head and Line Funds made healthy profits, marred only slightly by the Overs/Unders Fund’s small loss. The Recommended Portfolio for that year finished up by just over 23c, with a 12.5% ROI on a 1.84 turn.

Next, a COVID-hit 2020 season provided fewer wagering opportunities, but still saw the Recommended Portfolio increase in value by about 14.5c, with a 13.8% ROI on a 1.05 turn.

Then, 2021 made it three years of profit in a row, despite a return to losses from the Overs/Unders Fund. Overall, the Recommended Portfolio finished up by just over 11c, with an 8.6% ROI on a 1.28 turn.

After that, 2022 turned on a season to remember, with all three Funds returning profits of between 26% and 46%. The Head to Head Fund turned 1.67 times and had a 21% ROI to finish up by 35c, the Line Fund turned 1.1 times and had a 42% ROI to finish up by 46c, and the Over/Under Fund turned 1.26 times and had a 20% ROI to finish up by 26c. Overall, the Recommended Portfolio finished up by just under 42c, with a 32.5% ROI on a 1.28 turn. That figure of 42c remains the single-season record.

Next, 2023 was another solid season with all three Funds again in the black. The Head to Head Fund finished up by 14.4c on a 12.3% ROI and 1.17 turn, the Line Fund up by 25.3c on a 23% ROI and 1,10 turn, and the Overs/Unders Fund up by 12.5c on an 8.3% ROI and 1.5 turn. That left the Recommended Portfolio up by 21.4c on an 18.7% ROI and 1.14 turn, and meant that this Portfolio had returned a profit 5 years in a row.

That run ended emphatically in 2024 when all three Funds turned in red ink on relatively large turns, which turned ROIs in the -5% to -15% range into ROFs of -22% to -39% range. In the end, the Combined Portfolio finished down by just over 27c, which represents the third-worst single season performance in MAFL history.

2025, included a jaunty start that saw the Recommended Portfolio up by almost 25c to the end of Round 8, followed by a horror run of losses from Round 9 to Round 20 that left the Recommended Portfolio down by 3c. Thereafter followed two solidly profitable rounds before some small losses in the remainder of the homa nd away season leading up to a mildly unprofitable Final series. In the end, the Head to Head Fund finished at 74.3c from a -12% ROI on a 2.1 turn, the Line Fund at $1.21 from a +8% ROI on a 2.6 turn, and the Overs/Under Fund finished at 95.8c from a -2% ROI on a 2 turn. That left the Recommended Portfolio up by just under 7c.

So, had you been in on MAFL from the beginning, investing the same amount in the Recommended Portfolio at the start of every season and withdrawing your funds at the end of each season, every $1 you'd invested would today be worth about $1.03 including that Special Stupidity Dividend (SSD) of 2006. If, instead, you'd reinvested the previous season's proceeds every season, then your original $1 would be worth about $1.23, again including the SSD.

Onward.

Women’s

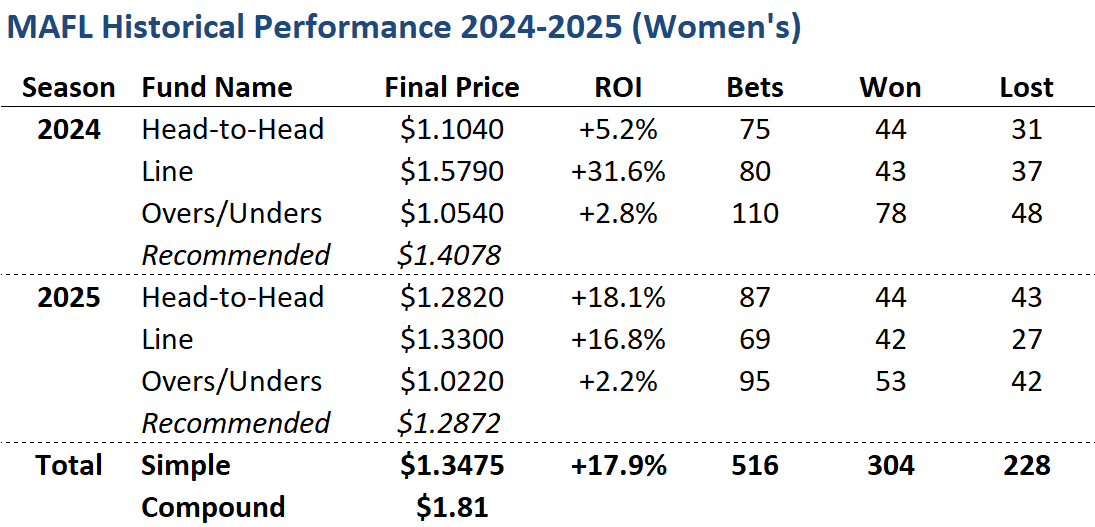

We only commenced wagering on the AFLW in 2024, at which point is was felt that sufficient historical data was available to allow for the construction and tuning of a team ratings-based predictive model with sufficient accuracy to safely take on the bookmakers.

The first year of using this model proved to be quite lucrative, with all three models returning a profit, especially the Line Fund, which represents 65% of the Recommended Portfolio. 2024 finished with that Portfolio at just under $1.41 from a +21.7 ROI on a 1.88 turn.

Year two, 2025, was a little less lucrative, but pleasingly profitable nonetheless, with all three Funds once again finishing in profit and with the Line Fund once more the standout. Come season’s end, the Recommended Portfolio was at just under $1.29 from a +16.3% ROI on a 1.77 turn.

So, had you been in on MAFL from the beginning, investing the same amount in the Recommended Portfolio at the start of every season and withdrawing your funds at the end of each season, every $1 you'd invested would today be worth about $1.35. If, instead, you'd reinvested the previous season's proceeds every season, then your original $1 would be worth about $1.81.